Are Salary Increases Outpacing Inflation In 2025?

📝 usncan Note: Are Salary Increases Outpacing Inflation In 2025?

Disclaimer: This content has been prepared based on currently trending topics to increase your awareness.

The first six months of 2025 reflected a decline in actual salary increases over predictions in many countries around the world, remaining lower than the previous year but higher than averages over the past 20 years.

getty

The first six months of 2025 reflected a decline in actual salary increases over predictions in many countries around the world, remaining lower than the previous year but generally above inflation and higher than averages over the past 20 years. Amidst market volatility, effective leaders understand and plan for the relationship between salary increases, labor shortages and inflation.

What is happening to salaries in 2025?

WTW’s recent 2025 Global Salary Budget Planning Report reveals actual salary increases are lower so far in 2025 than predicted in several countries, including China, France, Germany, the U.K. and the U.S. Actual salary increases match predictions in Canada and Saudi Arabia. In the U.S., for example, in 2025 planned increases were 3.9%, but actual increases in 2025 were 3.5% (For reference, actual salary increases in 2024 were 4.0%).

Salary increases remain at a relatively high rate by historic standards (the pre-pandemic norm was 3%) amid higher total labor expenses, which include salaries, bonuses, variable pay and benefits costs. WTW’s Brittany Innes reports the top reason organizations cite for reducing salary budgets is weaker financial results or concerns over recession. The second is uneasiness related to cost management, such as the rising cost of supplies. Uncertainty around inflation continues to influence spending for many organizations and remains a top factor in influencing budget changes.

What is happening with inflation in 2025?

Inflation trends vary by country in 2025. In the U.K., for example, inflation increased materially from 2.6% in March to 3.5% in April, 3.4% in May and 3.6% in June (after being as low as 1.7% in September 2024). While more favorable than during the peak of 11.1% in 2022, the trend concerns many leaders.

Inflation in the Eurozone was 2.0% in June, down from 2.2% in April and up from 1.7% in September 2024. The U.S. was 2.7% in June, up from 2.4% in April and in September 2024. Canada was 1.9% in June, up from 1.7% in May, and 1.6% in September 2024. While many leaders are relieved that inflation is lower than it was at its peak, they remain anxious about it increasing again given the changing economic policies resulting from 2024 national elections.

Salary increase budgets likely will outpace inflation in 2025 in some but not all countries. For example, Canadian salary increases of 3.5% materially outpaced the 1.9% June 2025 12-month inflation rate. But U.K. salary increases of 3.6% match the June 2025 12-month inflation rate and could trail inflation if salary increases continue to decline and inflation increases.

Why do salary increases and inflation sometimes move differently?

As previously reported, while inflation and salary increases generally move in the same direction, they are driven by different factors. Inflation represents changes in the cost of a market basket of goods (such as groceries and fuel). Salary increases, on the other hand, are driven by changes in supply and demand for labor, which can be caused by demographic trends, labor participation rates, technological advances and growth in productivity. When labor demand is high, inflation and salaries tend to rise faster. When labor demand is low, salaries and inflation generally increase more slowly.

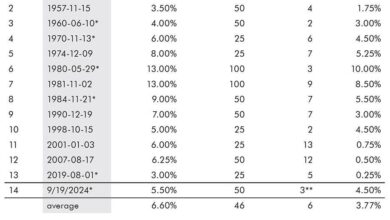

For the 20 years before the pandemic, salary increases outpaced inflation in countries such as the U.S. However, during the high-inflation years of 2021 and 2022, the numbers were flipped, with inflation higher than salary increases. In 2023 and 2024, salary increases again outpaced inflation.

What are effective leaders doing?

To remain competitive while watching costs in changing economic environments, effective leaders take the following actions when planning salary budgets:

- Budget for stability – Effective leaders prepare for a future in which salary budgets do not grow or vary at the rates observed in recent years. They watch the market and workforce data closely knowing that circumstances change quickly, aiming to validate pay competitiveness without falling behind on efforts to attract, retain and engage colleagues.

- Practice geographic customization – Effective leaders at global companies tailor their compensation strategies to address country-specific or regional economic conditions, recognizing divergence in salary growth trends in different markets. They understand that practices vary widely across geographies and that one size does not fit all in 2025.

- Focus on total rewards, including benefits – Effective leaders look at pay, benefits, wellbeing and careers holistically and develop programs that help attract and retain talent while managing costs during times of economic change. They know employees deeply value employee benefits such as healthcare and retirement. Their costs to both companies and employees continue to increase in 2025, but are not captured in salary increase budgets.

- Enhance the employee value proposition and the employee experience – Effective leaders enrich their employee value proposition beyond pay and benefits through a variety of means, including career development and other employee engagement efforts. A positive employee experience is characterized by a work environment where employees feel valued, engaged and connected to the organization’s purpose. WTW research shows that organizations with high-performing employee experiences outperform those without.

- Focus on flexibility – WTW research also shows that effective leaders understand that employees value choice, and use flexibility to create differentiated programs to attract and retain employees. This includes giving employees alternative programs (such as different types of benefits) as well as work arrangements. WTW’s Global Benefits Attitudes Survey shows that, in many cases, employees are willing to accept lower pay in return for work-location flexibility.

- Focus on key employees, skills and roles – Effective leaders understand that salary budgets only go so far. During times of inflation, recession concerns and cost management, they make tough decisions in determining which skills and roles are most critical, and focus pay investment on employees with such skills as well as high performers.

As employers navigate continued economic uncertainty, ongoing increases in labor costs and the changing needs and expectations of employees, they are positioning themselves for what is to come and making investments in their workforces that go beyond salary increases. These include career development, wellbeing and flexibility because these are critical for performance, retention and resilience in a shifting market,” said WTW Managing Director Lori Wisper in recent comments related to the survey.