Restore Trust In Congress Act—Missteps And Mistakes

📝 usncan Note: Restore Trust In Congress Act—Missteps And Mistakes

Disclaimer: This content has been prepared based on currently trending topics to increase your awareness.

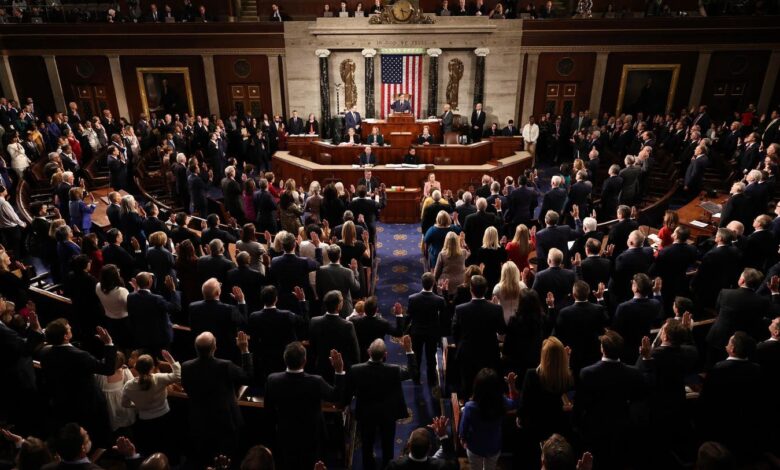

WASHINGTON, DC – JANUARY 03: U.S. Representatives of the 119th Congress are sworn in during the first day of session in the House Chamber of the U.S. Capitol Building on January 03, 2025 in Washington, DC. Rep. Mike Johnson (R-LA) retained his Speakership in the face of opposition within his own party as the 119th Congress holds its first session to vote for a new Speaker of the House. (Photo by Chip Somodevilla/Getty Images)

Getty Images

Every few years, Congress remembers that it probably shouldn’t be allowed to play the stock market like a fantasy football league with insider information on plays. And, every time, opponents recoil in horror—not at the ethics violation, but at the idea that members may have to pay taxes if they are forced to sell their holdings.

Now comes a bipartisan bill that, at least on paper, seeks to resolve this dilemma by banning individual stock ownership for members of Congress. At the same time, by way of a sweetener, lawmakers propose giving members a tax deferralon any gains from those sales. It is pitched as a compromise, but in reality, it’s a policy Frankenstein: half ethics reform, half boutique tax shelter, all bad for good government.

What the Restore Trust in Congress Act Does

The Restore Trust in Congress Act does what it says on the label. It prohibits members of Congress, their spouses, and their dependent children from owning or trading individual stocks, commodities, futures, or even derivative assets and options. In short, if it was passed as proposed, it would mean no more betting on Tesla or buying call options on defense contractors while simultaneously hammering out the next Pentagon budget.

The bill requires current lawmakers to divest within 180 days, and gives new members 90 days from their swearing-in. It carves out the usual safe harbors—more abstract holdings like mutual funds, Treasury bonds, and index funds. Municipal bonds are still fair game, as well.

The bill classifies itself as a federal conflict-of-interest statute, which would make divesting members eligible for preferred tax treatment under Section 1043 of the Internal Revenue Code. The provision is designed to allow government officials to defer capital gain taxes when they sell assets in compliance with ethics rules—provided they reinvest the proceeds in diversified investments like mutual funds.

So instead of a clean ethics rule, we get an ethics rule plus a sweetheart deferral. Congress isn’t just instructing its members to clean up their portfolios before they swear-in—it’s offering them a spoonful of tax break to help the ethical medicine go down.

The Policy Logic—And Its Inversion

The logic is simple on its face: if you want members of Congress to divest from conflicted asset holdings, you have to make it painless—if not enjoyable. In tax terms, apparently, there is nothing more painful than realizing the capital gains on long-held stock. The bill tries to remove that obstacle by offering a tax deferral through a certificate of divestiture, which is already available to certain executive branch officials.

Supporters argue that this just levels the playing field—a curious defense. If the problem is public officials profiting from decisions they make in office, then the solution shouldn’t be contingent on making that transition tax-neutral. The financial inconvenience of paying capital gains taxes owed on investments isn’t some kind of constitutional crisis created by demanding a more ethical legislature, it’s a feature of a tax code that applies to everyone else.

And since when do we need to incentivize ethics? Lawmakers are public servants, not reluctant volunteers conscripted into duty. If avoiding conflicts of interest is so burdensome, perhaps we’ve misunderstood what it means to serve in public office. If not, why haven’t we extended the same logic to judges or prosecutors? “Your Honor, we would very much like you to recuse yourself in this case—but please allow us to sweeten the deal for you.”

Perverse Incentive for Office

This isn’t about fairness, it’s just about comfort. When we start redesigning ethics laws around comfort of the regulated class, we have lost the plot. And that’s when things start to get messy. For instance, it is worth noting that by extending tax deferral through the divestiture certificate process, we have created a perverse incentive where one might run for office just to claim the benefit.

Section 1043 of the tax code was designed for executive branch officials entering roles where holding certain assets could create conflicts. Think, for instance, a cabinet member offloading ExxonMobil stock prior to taking over regulating oil markets. The trigger, however, is specific: the divestiture must be mandatory, and ethics related. This bill goes out of its way to unlock the tax break generally for members.

This converts pursuit of public office into a viable tax strategy. Imagine a wealthy private equity partner with a $10 million unrealized gain in Meta. What’s cheaper, paying the IRS now or launching a well-funded congressional campaign in a friendly district? Suddenly, the Restore Trust in Congress Act looks more like the Monetize Your Portfolio via Congress Act.

We already have enough folks running for office to boost their brand, sell a book, or land a television deal—do we really want to add “defer my capital gains” to the list of socially acceptable motives?

Larger Message

Even if no one actually runs for Congress just for a tax break—and let’s be real, someone will—the existence of that incentive speaks volumes. The bill conflates ethics with tax relief and reinforces the idea that lawmakers need a sweet treat to behave ethically. It reduces public trust to a line item on a balance sheet that can be offset by a credit elsewhere.

The fundamental question is whether we should be negotiating with members of Congress about the price of not using their office to line their own pockets. Do we really believe stock trading is inherently a conflict of interest? If so, ban it. If not, then stop pretending ethics reform is the goal and just admit this is eyewash.

Public services isn’t supposed to be risk-free or profit-maximizing. It is supposed to be a privilege that comes with equal parts restraint. That isn’t punitive; it’s the whole point.