Experiences, Sustainability And Perks Win Gen Z

📝 usncan Note: Experiences, Sustainability And Perks Win Gen Z

Disclaimer: This content has been prepared based on currently trending topics to increase your awareness.

Consumers love perks. From complimentary airport lounge access to surprise free drinks at their neighborhood bar, the promise of value fuels loyalty – or at least drives usage. But the next generation of credit card perks and loyalty is evolving quickly, blending data, travel benefits, and everyday savings into interconnected ecosystems designed as much around breakage as around generosity.

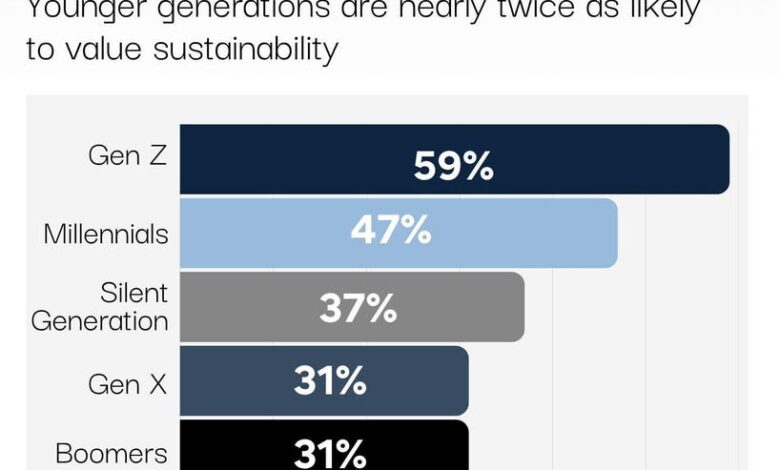

Younger generations are about twice as likely to value sustainability in the card ecosystem.

CardRates.com

The Two Paths of Modern Credit Card Loyalty

“There are really two swim lanes with card loyalty,” explained Marc Butterfield, Senior Vice President at FNBO, when we spoke recently. “One is you provide the loyalty directly as the card issuer, and the other is you augment it and enhance it with another brand.”

FNBO, the 15th largest card issuer in the U.S., often partners with brands like Universal Studios to enhance loyalty. For example, Universal cardholders receive perks like 10% off food and merchandise and lounge access at its parks. These tangible, immediate benefits drive usage and create a branded lifestyle halo.

Yet the industry giants – Chase, American Express, and Capital One – are pursuing different loyalty frontiers, shifting the entire category’s value proposition.

The Rise of Fee-Based Perk Ecosystems

Historically, many consumers balked at credit card annual fees. Today, that attitude is shifting.

“The percent of customers taking credit cards with annual fees has gone up every year for the past five years,” Butterfield noted. “People are willing – they’ll never tell you they want to pay a fee on a card – but if you attach enough benefits to it, and they do the math in their head, they justify it.”

This insight explains why Chase recently raised fees on premium products like its Sapphire Reserve. The psychological equation is simple: if a $550 annual fee unlocks hundreds of dollars in travel credits, lounge access, and food delivery subscriptions, the card feels like a savings vehicle. As Butterfield put it, “Amex basically created that industry. If I charge a customer X, I can promote Y value. And that’s separate from earning points.”

But the game isn’t solely about providing value. It’s also about breakage – the portion of promised benefits a consumer never redeems. Butterfield explained: “Chase tells me I can get up to $500 worth of benefits on my Sapphire Preferred card. What they’re relying on is that I don’t actually get the full $500 of that value.”

Breakage, Spend, and Merchant Fees

Breakage isn’t the only lever in the model. High spend drives merchant fees, but interchange revenue growth is stagnating across issuers. Butterfield emphasized, “That interchange revenue that the bank is getting is not an increasing number year over year. Just giving more points in categories isn’t making issuers more money.”

As a result, companies funnel consumers toward their owned travel centers – Chase Travel or Amex Travel – where they earn higher margins as both card issuers and travel merchants. “If I book directly through American Airlines, it’s 2x points,” Butterfield explained. “If I book through Chase Travel, it’s 5x. They’re trying to funnel me to their site.”

Capital One: Data as Currency

Capital One is taking a slightly different tack by betting on data. Its Capital One Shopping browser extension isn’t limited to cardholders. It offers discount codes and savings suggestions to any user who installs it, creating immediate value in exchange for shopping data.

“They see value in the shopping data,” said Butterfield. “My wife uses it all the time. She gets value out of it and doesn’t care about the data tradeoff. That’s the main layer on the shopping side: are you enhancing the shopping experience mainly by saving me money?”

This approach creates a loyalty halo even before consumers become cardholders. And once they do, they receive deeper benefits within the Capital One Shopping ecosystem. Butterfield believes Capital One is best-in-class here: “They’re really good at enhancing the shopping experience.”

Experiential Perks Beyond Shopping and Travel

The third leg of modern perks strategies focuses on experiences. Mastercard offers “Priceless” experiences ranging from concert tickets to culinary tours. Visa activates its Olympic and World Cup sponsorships for cardholders. American Express curates exclusive events, from NBA All-Star weekends to private concerts.

Yet Butterfield is clear-eyed about the limitations of such high-profile perks. “It’s neat to talk about from a promotional standpoint,” he said. “But there’s not a lot of engagement or real loyalty there compared to everyday perks. I’m always using DoorDash, but how often am I going to the Super Bowl?”

Indeed, the future of experiential loyalty may lie closer to home. Recent Bilt innovations, for example, focus on neighborhood-based loyalty, providing complimentary espresso martinis or local comedy show tickets to residents living in its networked apartment communities. The lesson: experiences that feel attainable build stickier loyalty than once-in-a-lifetime events alone.

Gen Z and the Shift Toward Values-Based Loyalty

While many credit card perks focus on value and aspirational luxury, younger consumers may soon prompt credit card issuers’ adopt a more nuanced strategy to accommodate the different priorities of younger spenders.

A recent survey from CardRates.com found that nearly 60% of Gen Z cardholders say sustainability is highly important when choosing a credit card, nearly double the rate of Gen X and boomers. For these younger consumers, a card’s environmental footprint can be just as important as its APR or rewards structure- at least for now.

“Right now, as Gen Z becomes financial grownups, they see spending as a form of self-expression,” said Bobbi Rebell, CFP® and personal finance expert at CardRates.com. “They’re looking for products that align with their values. They want to virtue signal to their peers with their financial decisions, and that will demand the attention of card issuers.”

This shift may influence how future perks are designed, with green rewards, sustainable materials, or charitable tie-ins becoming more prominent.

The Strategic Shift: Loyalty as Ecosystem

Butterfield sees the entire category shifting toward ecosystem thinking. “Large issuers are trying to control the ecosystem,” he said. “It’s not just about points anymore. It’s about making the card central to shopping, travel, dining, and entertainment.”

That means broadening benefits while driving consumers toward issuer-controlled platforms. Chase, for instance, requires consumers to book through Chase Travel to access 5x point multipliers, capturing merchant fees, travel agency commissions, and card loyalty all in one funnel. Meanwhile, Capital One uses data to personalize savings and merchant targeting, with direct credit card benefits layered on top.

The Future of Perks

The next generation of credit card loyalty will balance value creation with strategic margin capture. Consumers will continue to seek value – both everyday savings and aspirational experiences. Issuers will continue to seek breakage, spend concentration, and ecosystem control.

In the words of Butterfield: “People think they’re getting value, and they are – but the issuer is getting value too. That’s the future of credit card perks.”