How To Protect Your Retirement Savings From Inflation

📝 usncan Note: How To Protect Your Retirement Savings From Inflation

Disclaimer: This content has been prepared based on currently trending topics to increase your awareness.

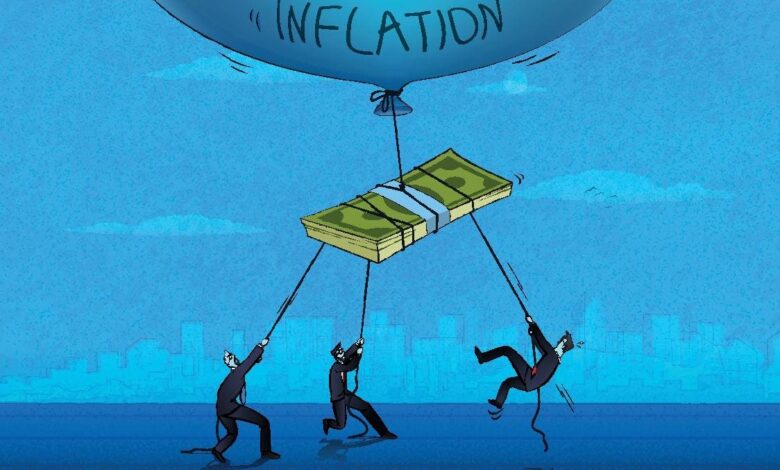

Though a cause for concern, inflation does not necessarily spell disaster for folks attempting to save for a happy retirement.

getty

A recent Money and Mental Health Survey found that 43% of U.S. adults admit to money negatively impacting their mental health at least occasionally. Among them, 69% cite inflation, or rising prices, as the primary stressor. This is up from 65% in 2024 and 68% in 2023, marking the highest level in three years.

Though a cause for concern, inflation does not necessarily spell disaster for folks attempting to save for a happy retirement. It is a persistent feature of modern economies by design, and attempts to eradicate it within that paradigm would be misguided. Indeed, a modest level of inflation is actually considered healthy for the U.S. economy.

Inflation Can Work In Your Favor—Here’s How

One reason a small level of inflation can be considered nearly essential is that it nudges individuals to spend and invest today rather than waiting for prices to increase tomorrow. Secondly, because cutting nominal wages often triggers backlash, inflation makes it easier for a company’s real wages to adjust without doing so. Finally, inflation can help borrowers repay loans with dollars that are “cheaper,” or less valuable, than when they originally borrowed.

As such, the Federal Reserve aims to achieve an annual inflation rate of 2%.

The Federal Reserve aims to achieve an annual inflation rate of 2%.

getty

The Overlooked Threat To Your Retirement

What does inflation mean for your retirement? It means every dollar not invested is typically losing at least 2% of purchasing power annually. While the idea of stagnant dollar bills “wilting” would be an exaggeration, that image effectively illustrates how money flow can affect the economy’s dynamics.

A helpful thought experiment is to consider pricing out a potential car purchase:

In 2020, a used car is selected with a sticker price of $30,000. However, due to unforeseen delays, the transaction is postponed. By 2023, inflation may have increased the price to $40,000. The original $30,000 set aside is no longer sufficient to buy the same vehicle.

Inflation can erode spending power, making previously affordable items unaffordable.

getty

Over a 20-year retirement, even modest inflation can erode purchasing power, limiting individuals from life experiences they could’ve otherwise afforded and, more importantly, cherished.

Beating Inflation Starts With Stocks

While inflationary trends can feel overwhelming, the good news is that investors do have tools to help manage the impact. While no investment is guaranteed, stocks have historically outpaced inflation over the long term, making them a commonly used tool to seek growth.

When inflation increases, companies have the option to raise prices on goods to match their increased expenditures, which tends to keep profits steadier and dividend flows more consistent. In other words, companies can inflate along with inflation, and consequently, those who own shares in these companies may benefit.

One eye-opening example emerges from analyzing how dividend growth has outpaced inflation over time—offering a powerful hedge for preserving purchasing power. The data below encapsulates roughly 150 years, demonstrating dividend growth’s historical tendency to consistently eclipse inflation.

Annualized Dividend Growth of U.S. Stocks vs. Inflation 1871 – 2025.

Chart Created And Owned By Capital Investment Advisors using Bloomberg Terminal Software as of 6/30/2025; Shiller, R. Irrational Exuberance; Past performance is not predictive of future results. Please see important information at the end of this communication.

Bonds: Your Portfolio’s Unsung Risk Manager

Though typically attracting less attention than equities, bonds have often shown the ability to keep investors in front of inflation with lower volatility risk. The 2‑year Treasury yield recently stood at around 3.72%—above its long‑term average of roughly 3.2%. That yield may not spark lively cocktail party conversation, but when inflation’s running around 2.7%, it allows future retirees to maintain or slightly increase their spending strength.

Real Estate: A Concrete Counterbalance

Real estate can be a valuable inflation buffer. For many, their primary home appreciates at or above the rate of inflation, particularly during periods when building costs increase. According to the U.S. Treasury, inflation‑adjusted U.S. single‑family home prices were roughly 65% higher in June of 2024 than in 2000.

Real estate can be a valuable inflation buffer.

getty

Individuals who have paid off their mortgage can lock in housing costs, while others are forced to deal with rising rents and taxes. For those seeking similar benefits without the hassle of tenants’ late-night plumbing emergencies, real estate investment trusts (REITs) may be a practical option.

Bottom Line: Align Investments With Inflation’s Trajectory

Many view financial freedom as a crucial element of a happy retirement. Inflation isn’t going away—it’s built into our economy’s framework. Future and current happy retirees take the time to learn what tools can be used to keep their money growing at a positive real rate—one that exceeds inflation.

Rather than lamenting the increases and fearing price escalation, a more constructive attitude may be to harness inflation itself. A portfolio that seeks to invest in companies with pricing flexibility, dividend-paying stocks, risk-stabilizing bonds, and the protective benefits of real estate has the potential not only to stay ahead of inflation but also to leverage its trajectory for momentum.

A portfolio that seeks to invest in companies with pricing flexibility, dividend-paying stocks, risk-stabilizing bonds, and the protective benefits of real estate has the potential not only to stay ahead of inflation but also to leverage its trajectory for momentum.

getty

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.