The $700 Million Chinese Robot Startup That Wants To Take On Tesla

📝 usncan Note: The $700 Million Chinese Robot Startup That Wants To Take On Tesla

Disclaimer: This content has been prepared based on currently trending topics to increase your awareness.

Beijing-based Galaxea AI is shooting for the top of the global robot market with its R1 humanoid.

Ina nondescript building in Beijing’s Zhongguancun district, sometimes called China’s Silicon Valley, a training session is taking place one sweltering July afternoon. In a small, cluttered lab at Chinese robotics startup Galaxea AI, a young employee toggles a switch to direct a base-mounted robotic arm to turn on a nearby lamp. His colleague records a pair of mechanical arms smoothing out a wrinkled bedsheet as they attempt to make a bed.

These images and video clips will be used to help train the company’s proprietary AI model powering its R1 series of wheel-based humanoids. Standing at 1.7-meters tall, they’re designed to assist in factories, and in the not-so-distant future, in homes. That’s an ambitious goal for a two-year-old outfit in an industry racing to deliver next-generation robots expected to transform daily life.

“Our industry is actually developing very fast,” says Xu Huazhe, Galaxea AI’s 32-year-old cofounder and co-chief science officer, from a meeting room at the company’s modest headquarters. “To show our own progress, we need to work harder and even faster.”

An honoree of last year’s 100 To Watch list of small companies and startups on the rise in the region, Galaxea AI derives its name from the words “galaxy” and “sea,” reflecting the cofounders’ shoot-for-the-stars ambition while navigating challenges along the way, says Xu. The first target, adds the soft-spoken Stanford-trained engineer, is to deploy the R1 robots across assembly lines at scale within the next three years.

Automation already plays a significant role in manufacturing, with China a global leader in installing industrial robots across its factory floors, alongside South Korea (which has the highest density of robots per 10,000 employees) and Singapore, according to Frankfurt-based International Federation of Robotics (IFR), a nonprofit supporting robotics research. Galaxea AI’s R1 humanoids are aimed at repetitive tasks that require precision and dexterity, for example, when building a car, which still needs humans to assemble hundreds, sometimes thousands, of individual components.

Beyond the workplace, Xu confidently predicts his robots will be ready for home use in less than a decade to help with household chores like cooking, sweeping—and turning out a perfectly made bed. Investors are buying that vision. This July, Galaxea AI raised more than $100 million in series A funding from a consortium of backers including Hong Kong-based Capital Today, Chinese fintech company Ant Group and local services giant Meituan’s VC arm Long-Z Investments, at a valuation of $700 million. Xu says more fundraising is underway, at a targeted value of $1 billion, as the company readies its first yet-to-be-named two-legged humanoid for launch in 2026.

Its full-size, dual-arm R1 machines, which Galaxea AI began selling late last year, are priced between 320,000 yuan and 459,900 yuan (roughly $44,500 to $64,000), depending partly on bundled accessories, such as five-finger robotic hands instead of two-prong grippers. The company aims to ship up to 1,000 units by December, with half of those sales from China and half from overseas, including the U.S.—a key market for the firm’s international expansion, says Xu.

R1 Pro

Courtesy of Galaxea AI

The shipment goal might sound modest, but Xu is seeing the big picture. The world will be populated by 2 million humanoid robots by 2035, with 15,000 units shipped this year, says Shanghai-based UBS Securities analyst Phyllis Wang. Their numbers are projected to rocket to 300 million by 2050, bringing the total market value for such machines, including components and software, to as high as $1.7 trillion, she wrote in a July research note.

A scramble to gain a foothold in that space puts Galaxea AI on a collision course with other disruptors at home and overseas, including Tesla’s avant-garde Optimus model. The American tech giant’s billionaire founder, Elon Musk, wrote in a X post in July, that the bot will begin delivering food orders to customers at Tesla’s futuristic drive-up diner in Los Angeles next year. Still, even as Musk opined Optimus will be No.1 in the humanoid market on an analysts’ call in April, he expressed concern that “on the leaderboard, ranks two through ten will be Chinese companies.”

Rise of the Robot

The global humanoid population is expected to grow rapidly over the next decade, led by China and the U.S.

Source: BofA Global Research, UBS Securities

“A humanoid robot has a human-shaped body that typically includes a head, torso and two arms, according to the International Federation of Robotics. Such robots can be bipedal or not, with both wheels and legs counting as locomotion.”

Xu sees Galaxea AI as a leading contender, pointing to the company’s talent pool of top scientists and engineers and its mission to build the better bot. The company is not there yet but making progress: In August it launched G0, an AI model that it says helps robots get better at understanding verbal orders, reasoning and performing relatively complex tasks (such as making beds). The model is built on datasets of robot behaviors collected by Galaxea AI in real-world environments including homes, stores and offices. The company also says it will allow others access to the datasets, as it seeks to underpin global humanoid development. Even so, Wang at UBS cautions that in general, it could take time for the technology to advance to allow robots to assist humans in a meaningful way in daily life.

Among Galaxea AI’s customers are U.S.-based AI firm Physical Intelligence and Stanford University, which has worked with the Chinese company to train R1 to perform tasks like dumping trash and cleaning the bathroom. Xu declines to name its industrial clients, citing nondisclosure agreements, but says Chinese car makers will use R1 to ferry goods across the factory floor starting later this year. The company did not record any revenue in 2024, but expects to achieve tens of millions of yuan in sales this year and is hoping to turn profitable in 2026.

“They are preparing society for a future next to humanoids.”

Reyk Knutsen, a robotics analyst at Florida research firm SemiAnalysis, says Galaxea AI has a good team in place, but faces intense domestic competition. There are probably some 30 to 40 humanoid makers in China, estimates BofA Global Research’s Hong Kong-based analyst Ming Hsun Lee. He likens the fledgling market to China’s electric vehicle sector a decade ago, when numerous firms were fighting for a slice as Beijing encouraged the development of EVs as a new growth pillar.

With an aging population and an expected labor shortage, China is pushing for the development of humanoids with state-led funding: In March, Beijing announced it was setting up a $138 billion fund to invest in robotics and other high-tech industries. To help its 1.4-billion population get comfortable with life with machines, the government has hosted events like the first World Humanoid Robot Games held in August in Beijing, where metallic participants from 16 countries faced off in events from soccer and kickboxing to dance. “They are preparing society for a future next to humanoids,” says Susanne Bieller, IFR’s general secretary.

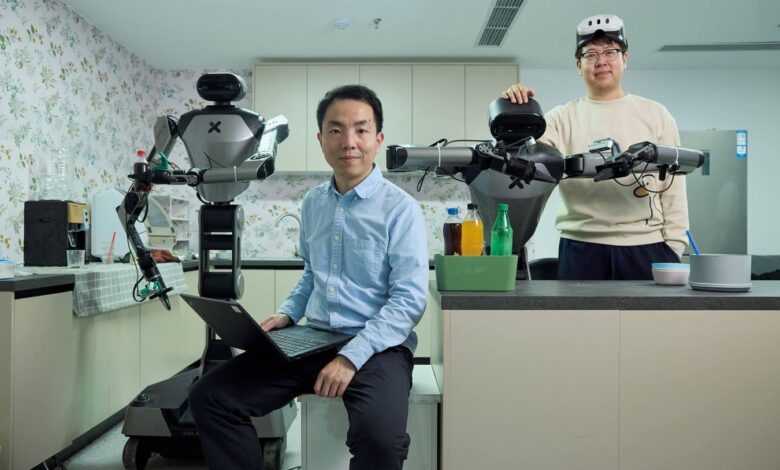

From left to right: Gao Jiyang, Zhao Hang, Xu Huazhe and Li Tianwei

Courtesy of Galaxea AI

Xu, who divides his time between his startup and teaching robotics and AI as an assistant professor at Tsinghua University in Beijing, is considered a top scientist in his field, says Sean Wang, a partner at investor Long-Z Investments. Galaxea AI’s four-member founding team draws on their individual strengths, with Xu and 34-year-old Zhao Hang, the company’s other chief science officer, working on the AI model and training the humanoids in Beijing. Gao Jiyang, Galaxea AI’s 33-year-old CEO, works with 31-year-old chief operating officer Li Tianwei at the company’s Suzhou factory to oversee production and drive commercialization.

The company plans to expand head count to 200 employees by year-end, up from the current 120, says Xu. He describes how Gao, who previously worked as an AI software engineer at autonomous driving companies including Waymo in the U.S. and Momenta in China, came to him with the idea for Galaxea AI. Xu felt the time was right, owing to rapid advances in AI.

The pair met as undergrads studying electrical engineering at Tsinghua University, with Gao a year senior to him. Xu, who grew up in the northeastern industrial city of Changchun, went on to pursue a Ph.D. in AI research from the University of California, Berkeley, followed by a year-long postdoc at Stanford University focused on computer vision-related technologies. In 2022, Xu accepted a teaching job at Tsinghua and returned to China, launching Galaxea AI with Gao the following year.

One of Galaxea AI’s biggest homegrown competitors is Unitree Robotics, a $1.7 billion (valuation) humanoid maker. The Hangzhou-based company recently made headlines with a budget-friendly humanoid capable of voice and image recognition that starts at $5,900. Xu says he expects Galaxea’s costs will come down, thanks to economy of scale, making it a viable choice for consumer use in the future.

The scientist thinks there may be too many humanoid robot companies in China right now, and predicts a wave of consolidation over the next three to five years. “After the bubble bursts…only the humanoid products that work will be left.”

More from Forbes